SPX historical comparison, possible for another 5 years of strong uptrend

SPX NYSE operating company only advance decline has been supportive during recent correction and is now breadth beginning to outpace SPX. Short term, it needs to move above 50-day moving average.

IWM iShares Russell 2000 ETF Broke the downtrend line Tuesday, horizontal line yesterday, and retested and bounced today. …..yep

VIX We broke < 17.50 today and couldn’t break above it. The close was 16.54. That should mean calmer winds and more predictability. Forget about early February; the winds have changed.

QQQ near all-time highs, 10/20/50 SMAs all trending up, and MACD above the 0 line while rising. Yes, I’m less cautious now. Dips are being bought and tech leaders are trending.

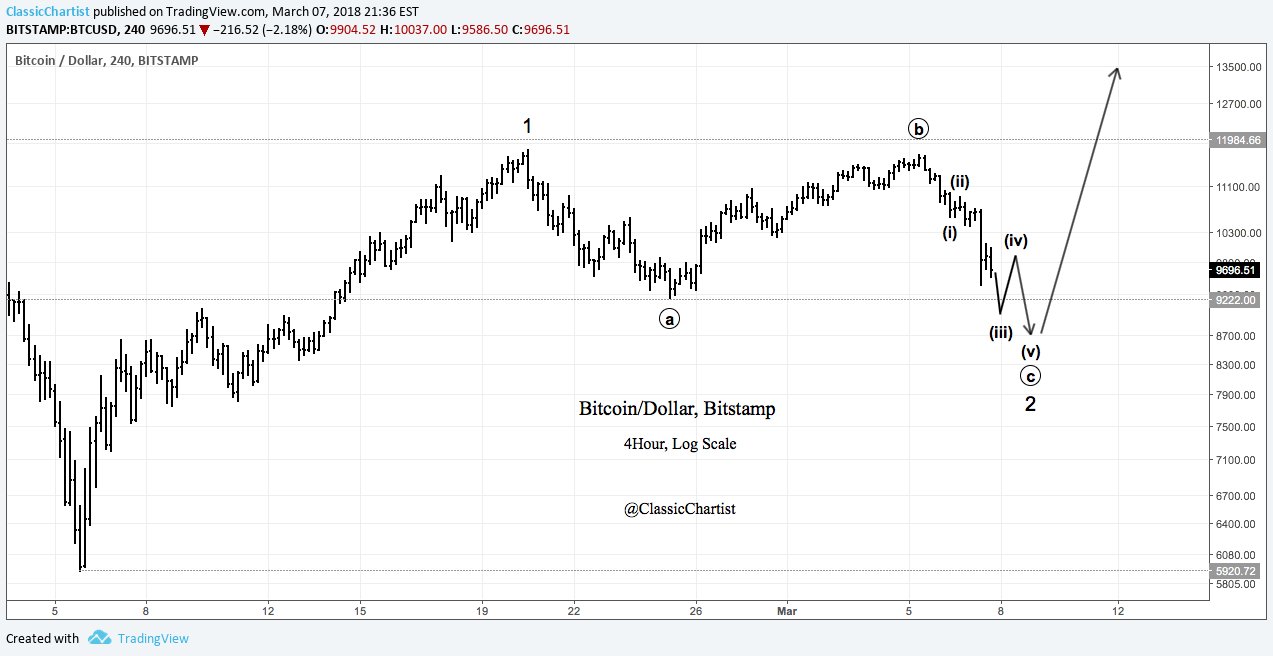

BTCUSD Crucial level for BTC to hold. Bulls need to make a stand here. Strong red bar down day Friday with close below 8700 would complete H&S failure with target at 3100.

不要忘了前几天的BTC的图,说好的8700已经到了,有可能是一个BEAR TRAP。风险要注意。

ALRM a lot of potential in its chart. nice little base. bullish momentum divergence on daily and weekly. rising 200 day MA. potential failed breakdown. Buy with a move above $39.20

GWW has the potential

ALGN triggered

AAPL long over 178.25

SQ continuously moves up

YY I like growth names, but this needs to set up and calm down. No playing hero here.